Let’s get an insight into the Venmo logo and some history behind the online payment app.

The Venmo logo is a typical example of a well-crafted visual identity: it has met the basic requirement of an iconic emblem. That’s simplicity, readability, uniqueness, versatility, and memorability. Practically, these qualities have made it influential and highly noticeable.

The Venmo logo appears in two parts—a wordmark and a graphic. To highlight its image, the designer executed the logotype in lowercase letters. The chosen font is a bold sans-serif type with a custom letter—V. Creatively, the same letter finds itself at the center of a rounded square.

More so, the harmony of the letter and square formed the graphic part of the logo. They dazzle in light blue and white. This conveys the feeling of loyalty, safety, and calmness. Interestingly, it has been exuding these emotions since 2009, when it first came out.

Today, PayPal, one of the world’s reputable financial brands, owns Venmo. She bought the then four-year-old company for $800 million from Braintree. It’s refreshing to note that Braintree acquired the brand a year earlier for $26.2 million from the founders.

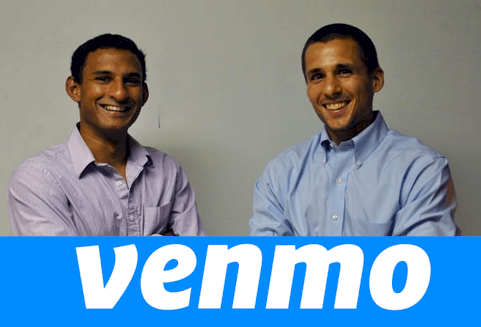

The desire to create a payment solution for a friend’s yogurt business inspired the creation of Venmo. This revelation came from Andrew Kortina, co-founder of the brand. The other partner is Iqram Magdon-Ismail, who he met at the University of Pennsylvania.

In 2020, the Venmo platform processed about $159 billion worth of transactions. This number should give you an idea about its popularity. And it’s a platform that facilitates peer-to-peer mobile transfer. Also, it ensures easy, fast, reliable, and secure cash payment.

Finally, Venmo is a combination of two words—vendere and mobile. In Latin, vendere means to sell. Therefore, you can confidently say that it signifies selling via mobile phones. In addition, the name is short, easy to spell, and distinct. These factors accounted for choosing the name.

Venmo Logo Evolution And Its History

A smart entrepreneur hardly changes an influential logo. And you can label the Venmo logo as one. For over a decade, the company’s visual ambassador has seen no update. So, it has kept its light blue and white personality in check. As a result, it has become a highly familiar logo.

Without wasting time, let’s study it further.

2009—Present:

The Venmo logo is sleek and visually enticing. It comprises two sections—a graphic and an inscription. The graphic part features a rounded square housing a custom letter—V. Artistically, the lone letter has a flat left bar and a curved right bar. This gives it a sense of pride and uniqueness. Then, beneath the stylized emblem, you’ll find the logotype in lowercase letters. Overall, the Venmo logo looks striking in an electric blue and white color scheme.

Why Does Venmo Logo Work?

- The Logo Is Attractive:

Given two logos—a dull one and a gorgeous one, which one would you spend time on? The option is clear and easy to pick. You wouldn’t waste time on the boring logo. And therefore, the Venmo logo is a winner. Yes, it has captured the users’ attention with its striking look. And so it has built trust and charmed its customers to stick around.

- The Logo Is Unique:

Anything unique stands tall. And it’s the same in marketing. Therefore, your logo should be outstanding to elevate your brand above competing ones. Thankfully, the Venmo logo adheres to this basic truth. So, it has a custom visual identity that sails through the noise easily.

- The Logo Is Simple:

The Venmo logo is people-friendly. To make its audience understand its message, it uses fewer elements. In addition, the graphic elements apply to its service offering. So the logo is quick to notice, process, and remember. Always be mindful; detailed logos aren’t effective.

- The Logo Is Memorable:

When your customers can remember your brand, you have a memorable logo. You can have a memorable logo by aiming for simplicity and uniqueness. Luckily, the Venmo logo shares these qualities, leaving a lasting impression. Remember, your brand shouldn’t be forgettable.

- The Logo Is Scalable:

Two factors—size and medium are likely to affect the quality of your design. Therefore, it’s smart to aim for a minimalist logo design. Importantly, the Venmo emblem can fit multiple advertising channels because it’s versatile. But, again, remember where your customers hang out.

Venmo Logo Design Elements

The company’s emblem comprises a square, a letter, an inscription, and two calming colors. For blending these design elements, the designer came up with a pleasing logo. In logical essence, it conveys the brand’s message, philosophy, and charisma to its audience.

Now, since each graphic element has an emotion, let’s uncover them.

Venmo Logo Shape And Symbols

- A Square:

Venmo, the online payment platform, has a square protecting its letter—V. Interestingly, the lone letter references the brand’s name. The rounded square is a mark of earthly matter and reality. In most cultures, it symbolizes unity, stability, and order. Again, it signifies security and justice.

Venmo Logo Colors

- A Blue Color:

The color blue marks the personality of the Venmo brand. It paints the square and the company’s name in a calming fashion. It’s the most favored color among financial brands, so, a good choice. Blue is a primary color that signifies freedom, trust, intuition, and imagination. Again, the color of the sky conveys confidence, stability, and harmony.

- A White Color:

To convey its second emotion, Venmo uses white as an official color. It captures the image of the stylized letter inside the square, giving it clarity. In design and some cultures, white represents goodness, purity, and humility. In addition, it signifies cleanliness, safety, and trust.

What Is the Venmo Logo Font?

The Venmo logo uses a clean font, evoking its exceptional personality. It’s a bold and modern sans-serif font similar to the Helvetica Neue typeface. Still, with a refined letter—V. In addition, the lowercase letterings resemble Ronnie ExtraBold Italic and Klein Condensed ExtraBold Italic.

Is Venmo A Registered Trademark?

The Venmo visual ambassador isn’t a public domain property. Its owners filed and registered it on October 25, 2016. The trademark office assigned 5067594 as its registered number. And Karen A. Webb, an attorney, supervised its registration.

Why Is It Called Venmo?

According to Andrew Kortina, co-founder, they wanted a short, easy to spell, verb, and costive name to buy on GoDaddy. So, with these attributes in mind, they settled for Venmo, a portmanteau name. Interestingly, the first three letters came from vendere, which means selling in Latin. Then, the remaining letters came from mobile, conveying the brand’s platform.

Can I Use Venmo Logo?

The quickest answer is yes; you can use the Venmo logo. However, it’s safe to seek permission from its owners as it’s an intellectual property. Be mindful that the company has branding strategies you must follow. These guidelines are:

- You shouldn’t use the Venmo logo inline within a block of text.

- You shouldn’t use the shortened Venmo logo in places where Venmo isn’t well known.

- You should always use the Venmo logo in its official blue and white colors.

- You should allow enough space between the Venmo logo and other graphics next to it.

- You should ensure the Venmo logo isn’t smaller than 5 inches or 48 pixels wide.

- When making attributions, never use the logo, instead use the text—powered by Venmo.

What Company Owns Venmo?

In 2013, PayPal bought Braintree, including Venmo, for $800 million. As most people know, PayPal is an American financial giant operating an online payment system. It began in 1998 with five visionary partners—Peter Thiel, Luke Nosek, Max Levchin, Elon Musk, and Yu Pan.

Why Is the Venmo Logo Popular?

No one can deny the fame of the brand and its logo. Yet, there’s no impact without a cause. So, there are a few underlying factors behind the logo’s visibility. First, people are attracted to its free and convenient means of sending and receiving money.

Second, its primary millennial users love the idea of splitting bills with their friends. Yes, the app makes it handy for them to share almost any fee with their loved ones. You can think of bills like rent, movies, dinner, and transport, among others.

Third, Venmo users can make payments even with an insufficient Venmo balance. Interestingly, the company can recoup the differences via their savings accounts, credit cards, or debit cards.

Again, the brand is noticeable because of its aggressive marketing plan since 2015. For using the slogan—Pay with Venmo, the logo has gained traction. More so, word-of-mouth and outdoor advertising have increased its persona. That’s why it’s trending on several social media sites.

How Does Venmo Work?

To use Venmo, you start by creating an account using either the mobile app or the website. Once you fill in your personal and bank details, you’re set to use the platform. Now you can pay any user through their username, email, or phone number. And there’s no transaction fee.

However, there’s a standard 3% charge for using a credit card. Again, withdrawals are free and often take a couple of days. Yet, you can lessen the days by paying a tiny fee for a quick transfer. In addition, you can use the Venmo platform to split bills with your friends and family.

Are you wondering how to do this?

Well, look at this practical scenario: In a company of friends, you go out to eat in a cafeteria. After the food, you can pay by splitting the bill with your friends. Here, each person sends their share to you, and finally, you can make the full payment to the cafeteria. Easy, right!

You can use this same approach to pay for movies, dinner, tickets, transport services, etc. However, remember this payment would come from three sources. These are your Venmo balance, debit or credit card, and bank account balance.

Who Founded Venmo?

Two friends—Andrew Kortina and Iqram Magdon-Ismail founded Venmo in 2009. However, they met as freshmen at the University of Pennsylvania eight years earlier. At the university, both started as computer science students.

But Kortina changed his program of study, majoring in philosophy and creative writing instead. They founded their first business—My College Post while in school. It was a classified website for students. Though this business wasn’t successful, it was a good learning curve.

After graduating in 2005, they worked at different companies before founding Venmo. For instance, Iqram worked at Ticketleap while Kortina found himself with Bit.ly. However, their shared desires and experiences unite them in the formation of Venmo.

Initially, raising funds for the startup was an enormous challenge. For example, some investors thought it wasn’t a billion-dollar idea. But, quickly, Iqram remarked it would be a trillion-dollar. Sooner or later, they attracted funders, including angel investors.

A Brief History of Venmo

In 2009, Andrew Kortina and Iqram Magdon-Ismail founded Venmo. It’s an American mobile payment application that allows users to transfer money. Originally, it was aimed at friends and relatives who desired to share bills. For instance, the bills include dinner, movie, rent, ticket, etc.

The two partners, in 2001, met at the University of Pennsylvania. While Iqram majored in computer science, Kortina pursued philosophy and creative writing. However, before creating Venmo, the pair had worked on several projects and jobs.

This increased their coding knowledge and also gave them actual business experience. For instance, they built a classified site called My College Post. And it was their maiden project. Also, Kortina worked at Bit.ly and Iqram with Ticketleap. These are all tech companies.

Now, three instances inspired the creation of Venmo. First, an attempt to help their friend open a yogurt shop unveiled how awful traditional sales software was.

The second incident was at a local jazz show. Here, they thought of instantly buying an MP3 of the show via text messages.

And third, the incident that flung them into action happened when Iqram visited Kortina. Suddenly, Iqram realized he had forgotten his wallet. So, his friend sorted him out for the weekend. Interestingly, this led to the birth of Venmo—a mobile app for money transfers.

The prototype was SMS-based, and it was unbelievably simple. However, they updated it to a smartphone app, making it modern and convenient. After the initial challenges, the duo raised $1.2 million in May 2010. RRE Ventures led this round of seed funding for the company.

In 2012, Braintree bought the company for $26.2 million. Then, in December 2013, PayPal also gained Braintree for $800 million. With this purchase, Venmo automatically became part of PayPal. In 2016, Venmo began working with selected merchants—Munchery and Gametime.

In 2018, Venmo partnered with MasterCard. The deal allows users to use a debit card on the MasterCard network. Also, they have access to ATM and overdraft protection, limiting them to $400 daily ATM withdrawals. But, again, they can use it anywhere that accepts MasterCard.

In 2020, Venmo began a plan to allow its users to use Bitcoin, Ethereum, Litecoin, etc., in selected international markets. Meanwhile, in April 2021, the company unveiled plans to allow people to buy, hold, and sell cryptocurrencies on the platform.

Today, Venmo has become a household name and a verb among its over 52 million users.

Bringing Down the Curtains On Venmo Logo And Its History

Venmo is an American leading payment app that facilitates money transfers. And though it was created by Andrew Kortina and Iqram Magdon-Ismail, PayPal owns it today. In 2009, the app and its logo came into existence. The logo is attractive, simple, unique, and unforgettable.

The name Venmo means—to sell via mobile application. The founders combined the words—vendere and mobile to coin the name. In Latin, vendere means to sell. In addition, they chose the name because it’s short, easy to spell, distinct, and available on GoDaddy.

It’s interesting to know that Venmo has attracted several competitors. So, it’s easy to find Google Pay, Apple Pay, and Zelle Pay on the market. Also, a few others include Meta, Popmoney, and Cash App. But, despite their presence, Venmo is enjoying a massive following.

Finally, Venmo has become an active verb, rocking shoulders with Google and the likes.