Are you thinking of starting your own business? Of course, you are!

You will have many gut feelings in your life. Still, any ideas regarding a potential business concept warrant a meticulous and thoughtful evaluation process along with research and planning.

Will your product or service sell? How large is the market? Do you know your customers will react to it, and do you know if they will choose you over your competition? Continue reading and we’ll give you some valuable pointers on how to start your own business.

Will my business idea work?

We’re sure you have great ideas for your business, but great ideas are not enough on their own. Whether you’ve come up with a lucrative product or spotted a gap in the market only you can fill, you will require a plan and a healthy amount of business acumen to go the distance.

During this stage, you do your research and find out precisely what you are up against. Consider your pricing, marketing, cost base, and overheads. You also need to determine whether you have the right attitude and mindset for what is ahead – success is a very stressful path.

Even if you have all the required characteristics to make it in business, remember that you will have to have the energy, endurance, and commitment to create a profitable business.

Before you brainstorm business ideas you can use a great tool called “Google Trends“. You can type any keyword and see the popularity of that word or phrase. This is a great way to see what people are searching and what new businesses that might be popping up in the future.

What are the common traits of a successful business?

If you wish to succeed, then your success will come from a combination of drive, skill, passion, and determination. 40% of businesses fail by the 5-year mark, usually because of a lacking in one of these areas.

One useful process for establishing is the viability of your business idea is to examine the SWOT analysis, a classic method of determining what you have in your bag of tricks:

Strength

Why is your product or service going to sell over anybody else’s? Will your costs be competitive? Will your product be superior? Are your marketing skills on the point of your pitching technique perfect?

Weaknesses

What could prevent your business from reaching its goals? What do you think those other businesses who share your vertical could do better than you? The clearer you understand your weaknesses, the more chance you have of shoring them up.

Opportunities

Are markets changing enough for your opportunities to become apparent? Have regulations shifted? Do you people have a pain point that you believe you can help with? This section of the SWOT process better understands the external environment into which your prospective business will launch.

Threats to success

As well as opportunities, the astute businessperson will always consider potential threats. No matter how much planning you do, any business operates with a certain uncertainty level due to the ever-changing world landscape. Here, we will consider what those changes could be and how they may affect your business.

What you must keep in mind is the SWOT Analysis has interconnecting parts. Strengths create opportunities, and weaknesses can be worked on, and so this will neutralize your threats. An action plan is also a good note to keep and a good habit to get into. This will outline a clear step moving forward and allow you to visualize your project and your goal much more straightforward.

The creation of your business

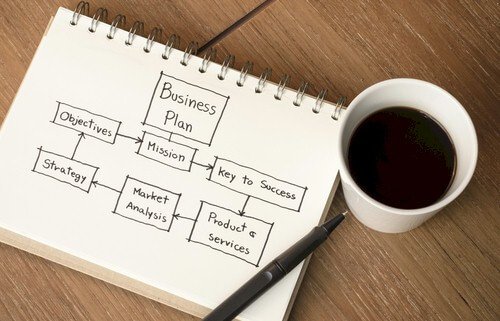

Just as no one builds a building without digging foundations or drawing up blueprints first, no one rushes into creating their dream business without a business plan.

How to create a business plan

Your business plan does not have to resemble ‘War & Peace,’ but it does have to be clear, logical, professional, and conducted with precision. You don’t need to show it to anyone, but you should know it front and back. Create a business plan with the care and professionalism it deserves, and it will reward you well.

When you did this correctly, the business plan will offer you a vast spectrum in achieving your business objectives. Your business plan certainly should include the following:

- Summarise what you’re trying to achieve

- Do your Market Analysis

- Reflect on your business and management structure

- The sales and marketing strategy

- The funding and costs requirements

- What is the financial projection over five years

- Appendix document

We can refer from this that this isn’t a one-off either that will just be filed away upon completion. The most superior business plans are the ones that behave like living documents, which you can use to monitor progress and adapt as your business takes form.

Finding a business mentor

Who is the great mentor of all time? That’s right, Obi-Wan Kenobi. He was Luke Skywalkers bottomless resource of information, his seasoned expert, and his vassal to encourage him to ‘use the force’ when he needed to most. You will need a mentor of a similar caliber.

Who is the great mentor of all time? That’s right, Obi-Wan Kenobi. He was Luke Skywalkers bottomless resource of information, his seasoned expert, and his vassal to encourage him to ‘use the force’ when he needed to most. You will need a mentor of a similar caliber.

For many people, a mentor may be as close to you as your contact list or email network. Many successful people don’t forget what it took to get where they are now and may be open to sharing their experiences with you for your more significant benefit. It’s also worth pointing out that the right mentor doesn’t have to be in your specific industry – though that is the ideal we all would like.

Here are a few ways to locate yourself the kind of Obi-Wan Kenobi mentor that you and your business deserve, assuming you’re having trouble finding one yourself through traditional channels and via your network.

Business mentor organizations

Mentorsme: The Business Finance Taskforce operates this hidden gem, and the website is designed as a portal to connect start-up businesses with mentors in your region. this is a fantastic resource that boasts over 27,000 listings from people who are all willing to give one hour of their time once a month for two years.

The Institute of Enterprise and Entrepreneurs – the IOEE is a dedicated learning institute for entrepreneurs’ support. Their membership gives access to online mentoring.

Planning & Registration

Now that your planning stage is complete and your business plan is in a constant set of positive evolution, the next step is to put all this information into effect.

That includes everything needed to turn that spectacular business idea into a lucrative company that can trade legally in your country of origin while meeting all the tax and accounting obligations along with it.

As the one in charge, there are a great many decisions that you will have to make to pursue your dream. From the legal structure of your affairs to your business’s name and a location for you to be based.

It will come down to what kind of work you and your business are looking to do. Still, there will inevitably be specific licenses and permits to apply for insurance cover that’s a legal requirement in your industry.

Limited Company, Partnership, or a Sole Trader

One of the primary business decisions you will need to make is selecting the company’s legal structure. There are several options open for you, all of which have their taxation laws, legal proceedings, and accounting requirements that you must be aware of. The four key options available to you are:

- Partnership

- Sole Trader

- Limited liability partnership (LLP)

- Limited liability company (LTD)

Sole traders and partnerships are very similar in terms of business structures, with one key difference. Sole traders are businesses with only one owner, whereas partnerships can have anything from 2-50 co-owners working cooperatively.

Both partnerships and sole traders are simple to set up and run. The business in question will have to be VAT-compliant and must tax to the proper authority. You and the businesses are one and the same, meaning you’ll be able to remove money from your company account and pay it into your home account whenever you see fit to do so.

Limited liability partnerships (LLP) are used by companies that provide professional business services such as accountancies or legal firm. They share several of the characteristics of a standard partnership, such as the tax liabilities and profit distribution. Still, there is also the benefit of the co-owners’ limited liability for the financial losses. The debts that the company accrues are limited to the amount that was initially invested in the business.

Private limited companies (LTD) are different in the sense that they are separate legal entities. That means your finances and the finances of the business must be kept apart from one another. The whole business is owned and controlled by its shareholders, and you, the founder, can select who to choose the shares to when you register the business officially.

A private limited company must possess certain standard legal documents that govern how the business operates. Yearly accounts must also be filed, and corporation and national tax must also be paid. This brings additional complexity and cost to the equation, as I’m sure you can imagine. However, private limited companies are more tax-efficient, and you are not financially liable if things don’t work out as intended.

Register your business

Starting your own business from scratch is not an easy task, so it’s very important you take the necessary steps to guard everything you create along the way and don’t allow it all to go to waste. If you don’t register important details such as your web domains, company name, and trademarks, it can make things much easier for your rivals to imitate everything you’ve done so far.

Must you register your business at the national level?

Registering your company is one of the very first and most simple steps you will need to take. Sole traders are not legally mandated to register national legal statures, such as Companies House in the UK. However, if you’re unsuccessful in registering your business in this way, there’s nothing to stop someone else from registering a business with your chosen trading name as well, and you may end up in a whole heap of mess in the long run.

Companies that describe themselves as ‘Limited’ are legally required to register with a national legal body. The process is relatively easy and can be completed easily alone. However, some third-party registrars will handle the registration process for a fee if that is something you think you will benefit from. To register, you will have to provide the name of your company, the address, and details of the company directors, if any (apart from yourself, of course). You’ll also have to make and submit the memorandum and articles that are needed.

These days, an online presence is an essential part of almost any business. One of the first steps in creating your online persona that will no doubt conquer the business world is to register a domain name. A domain name is the [yourbusinessname].co.UK, .com, or .net address (whichever domain you are in, worldwide) that customers use to find you on the internet.

Buying yourself a domain name is simple and relatively cheap in most available options, but it’s crucial you get one that’s memorable, short, and easy for any potential customers to remember. To purchase a domain name you can go to a registrar such as GoDaddy or 123-Reg, among other reputable sites, key in your domain, and pay a fee. The domain must be renewed annually.

Registering a Trademark

There is always the recognition factor to take into account when considering a trademark. Still, you can also register a trademark to protect your business’s name, brand, and products or services. Here’s a little list of what you can trademark:

- Names

- Slogans

- Logos

- Domain names

- Shapes

- Colors

- Sounds

- Any combination of the above

The first thing you should do is search the trademark database to see if anyone has registered a similar or identical trademarked name such as yours for similar goods or services. Once you have established registration, you will gain the option of taking legal action against anyone who uses your logo or any brand information without permission and display the ® symbol next to your brand.

Business licenses and permits

Certain categories of business require a license or a permit in order to operate legally. Commonly pertaining to businesses that engage in the sale of alcohol and tobacco products, but other forms of licenses are necessary for companies that would include but are not limited to:

- Restaurants

- Security businesses

- Farms

- Taxi firms

- Driving instructors

- Sports coaches

- Importers and exporters

- Childcare providers

- Food preparation businesses

- Manufacturing firms

- And many more…

The business owner must apply for the license or permit from the local authority that governs the locale that the business is in or the trade body for the sector concerned.

Serious ramifications will unfold upon you if you are not aware of the responsibilities that are the same as those with running a business that requires a permit or license, and that could potentially breach the law.

Finding a business location

Depending on the way you run your business, you might be able to save on the running cost of leasing property by running it from your own bedroom! If you do decide to choose to operate from your home, there are still quite a few factors to consider.

Depending on the way you run your business, you might be able to save on the running cost of leasing property by running it from your own bedroom! If you do decide to choose to operate from your home, there are still quite a few factors to consider.

One of them would be, if you plan on running your company from your home, then you might possibly need permission from your landlord, or mortgage provider, or whoever owns the property. If you have customers turning up regularly at your home to visit, you’ll be accepting regular deliveries, or you want to stick a big advertising billboard outside your home, then you may also need permission from the local council or government body. There’s also insurance to consider. The home insurance policy may not cover business equipment, stock, computers, or any of the other items needed for your business to function from this location.

If you’re looking at running a sole trader or partnership from home, you should include a proportion of your household costs in the application, like tax, electricity, heating, and internet.

Choosing a Commercial Premise

However, if you go for the other option of setting up your business in commercial property, here are just a few things you need to consider. The location of your premises can aid you to attract customers and employees. You should consider how the decision to rent or purchase your lands will impact your costs and think about the flexibility the building will give you if your requirements were to alter any time soon.

Several legal responsibilities come with buying or renting your own commercial property. You will have to carry out health and safety risk assessment checks, which will involve you removing any hazards that pose a danger to you and any staff you have. You will also be responsible for fire safety and the safety of electrical equipment.

Choosing a name for your business

Now we come to the fun part, giving a name to your creation. Picking the right name for your business can be surprisingly difficult. If you have a tested and tried product or service and have identified a gap in the market, you might think you don’t need to go any further, but your business name is still extremely important.

Perhaps you’ve put a bit of time into researching some business name ideas already, and you need to think about what will work for the marketing team and when you must inform your legal team of further proceedings. It should not be like any other businesses in your vertical and easily identifiable, so your customers can work out what you provide.

If you are looking to function only in your local area, incorporating that area into your company name can add a personable, friendly, and reassuring element to the business. Ideally, your business’s name should be short and sweet, snappy, and instantly informative to bring customers to your business while being trustworthy and professional.

There are times when business owners will try to be too clever and risk confusing their consumers, so always keep it simple and don’t try to do too much at once. While you may find it tempting to include your name in the business’s moniker, but he could unintentionally restrict your branding opportunities and give customers the impression that it’s a one-man-band operation rather than an established business. The law of ‘passing up’ prevents you from picking a business name that is identical or not far removed from a business operating already in your industry.

What are your company’s Accounting Obligations?

The prospect of having to keep the money records and produce company accounts could seem really eye-opening for some business owners, but this process doesn’t have to be a chore. No matter what your business is or where it has been set up, every business owner is legally mandated to keep financial records for six years, but the type of accounts you must give does depend on the legal structure of your company.

If you’re running a sole trader or partnership, there isn’t very much bookkeeping at all, accounting and filing requirements. This means that accounting costs are usually not quite as high for Limited Company as you may be able to live up to your accounting obligations on your own by using a spreadsheet or simple accounting software.

You must keep a mental note or a physical record of all your company’s income and outgoings from the outset so you can file and pay your taxes accurately and when it’s needed. You should also put all your receipts and invoices to help you complete your annual self-assessment tax return. If you employ people, then you also must keep a record of everything – what you paid them, when you hired them, benefits, everything.

The requirements of the accounting procedure for limited companies are more demanding. The accounting mandates for limited companies are more demanding. You must produce accounts at the end of the business’s financial year that must include:

- A balance sheet

- Profit and loss account

- Account notes

- Director’s report

You must also complete a tax return that must be filed with your national governing body (like the HMRC, for example) and be paid annually. Limited companies are legally required to have another business bank account, as we have mentioned previously.

These accounts that a lot of time and require much complex thought to follow through on, advice from a legal expert may be needed. Considering the vastness of the project, the vast majority of limited company directors and CEOs hire a small business accountant to prepare and put away accounts on their behalf – this saves on time but adds a little bit more to your end of month expenses. That ensures they are of the standard and will add expertise to your business that perhaps could not have been sourced from anywhere else.

How business taxes work accounts

You will most certainly have a bottomless pit of things to do and remember when starting up your business, but one that should remain right at the forefront of your mind is that you must remember to register your business (be it, sole trader or a partnership) with your national government authority.

In most countries, this can be done through your government’s national website, such as the HMRC website in the UK. Once you have registered, your national authority will let you know what your taxpayer reference code will be, and the process continues from there.

As the business owners, you are responsible for submitting your tax and ensuring all taxes are paid. Sole traders and those in partnerships will pay taxes on company profits by submitting a self-assessment tax return. As the founder of a limited company, you must register for and complete a self-assessment tax and register to pay corporation tax on your business profits. You must register for corporation tax within three months of starting to do business.

All businesses that have an annual turnover of more than £85,000 in the UK (whatever amount each state demands, in the US) must also register to pay VAT. In some cases, you may take it upon yourself to register for VAT even if your income doesn’t exceed that particular threshold. That’s because having a VAT number would most certainly add credibility to your business.

If you’re a sole trader or partnership in the United Kingdom, you’ll pay Class 4 and Class 2 National Insurance contributions through your assessment tax return, but you aren’t affected by PAYE. You will only need to register if you have people working for you.

Business Insurance

Insurance is one of the policies that you are required by law to put into place. What you specifically need to put into place will depend on the type of business you are looking to run and the industry that you open that business up into. There are also a large number of other policies that, even though they are optional, could well provide invaluable protection for all your hard work.

If you hire anyone other than a member of your immediate family member, then you will be legally required to pay employers liability insurance in place – hence the existence of so many family businesses and Mom and Pop stores. That even includes employees you employ on a non-full-time basis or casual basis. The employers’ liability insurance provides cover against the cost of a financial insurance claim, which arises from a worker who becomes injured at work. The failure to put employers’ liability insurance in place could lead to a fine.

Many small businesses also choose to take out public liability insurance, particularly if your consumers regularly visit the premises. The public liability insurance will protect your company against the cost of a compensation claim from a third party who is injured or taken ill and whose property is damaged by your business escapades. Although it is not a legal requirement, it could prevent the closure of your business if a claim is made.

Another category of insurance to consider is professional indemnity insurance, a policy many businesses decide to put in place for their ease and peace of mind. If your business provides a specific professional service or is a consultancy, this policy will protect you against claims from customers who are dissatisfied with the service or advice you have provided. This is not a legal requirement, but indemnity insurance is mandatory for members of some professional bodies and is required by regulators in high profile industries.

If you start a business that centers around a recognized profession, you should check what policies they recommend you look for. There are general policies that deal with other areas that you may wish to consider, which may cover topics like buildings insurance for your company location or goods in transit insurance to ensure your logistics empire stays on the right side of safe.

Business Support

When you start your business, you’ll face several tough challenges that may make you feel that you need to branch out to others to keep you with these tough decisions, some of which you may not feel equipped to decide. Using an adviser or even accessing some of the free support available could save you time and help to avoid a costly mistake.

There are a fair few national providers of free business support available all over the internet. Many others who have completed the same journey you’re about to embark on have chosen to access paid-for support services. One of the most common is an accountant for small businesses. You don’t need an accountant to set you up a company, but filing end of year accounts is more complicated than standard tax work. Small business accountants can arrange the filing of documents for you and handle your VAT obligations. The time they save could outweigh the costs.

Several entrepreneurs also access the support provided by a business mentor. If you happen to know anyone in your personal life who has already succeeded in the realm of big business, asking for their advice on almost anything could be vital. However, there are usually successful entrepreneurs who may have specific experience in your industry available from many sources. While some business mentors will charge, others may provide their help for free if your visions match up.

Hiring Employees

Once your start-up gets to the point where you are hiring your staff, it may feel like you are making headway with your ambitions. Now you’re an employer. It’s a reckoning that things are going well and demand for your products or services exceeds what you can deliver alone. It should be said, though, the process itself needs to be handled with care. You’ll have to keep in mind a few legal and financial considerations when hiring a new member of staff and bringing them into your team.

We would encourage that before you make the decision to hire, you must have a simplistic (but more experience is preferred) understanding of employment law and put the necessary statutory requirements in place. Employers must also enroll workers into a workplace pension scheme if they earn more than $15,000 per year.

Apprentices & Trainees

When you first consider your start-up business budget, you should consider that it will be inevitably tight, and the best employees are never cheap. However, there are some more cost-effective ways in which you could tackle this problem. Recruiters desire recruitment fees, and that may not be a possibility at this point in your journey, but an internship is one potential solution that is a win-win for many young start-ups.

Suppose you can get an extra pair of hands to fulfill a short-term employment need and benefit from the enthusiasm, new ideas, and range of skills an intern can bring. But another factor to consider about internships can also be an effective way to identify candidates that could be perfect for a constant role in the company as an apprentice or trainee.

Interns are recruited in the same way as you’d fill out a job application form or any other vacancy. You could simply place an advertisement and invite applications, shortlist candidates, and conduct interviews.

Suppose it is the permanent staff that you’re after. In that case, an apprentice or trainee may be a very wise and cost-effect way to bring an individual into the business who can develop into an important member of your team. There are start-up businesses that are hesitant to take on apprentices because of the red tape they believe is there, but it can be a fantastic way to fill a skills gap that is needed in your structure.

You can target the training apprentices and trainees in order to receive your specific business needs. They can also get you into a good habit of keeping you staying up to date with what’s happening in your vertical and give you relevant skills, especially digital skills.

Finding your business

Finding a decent source of external funding is a priority for many newly formed business owners, but raising the funds you need can be a challenging prospect to consider. You could consider a bank used to be the first port of call for a new business looking for funding and investment, but bank finance is a tricky thing to secure these days. However, there are a few other options:

Your family and friends – Financial investment from family and friends in return for a certain amount of equity in your business is a good place to start. You’ll be able to access the money at your convenience, and you can also negotiate a good deal in your favor, but as they are unlikely to be knowledgeable investors, you may not benefit from any advice or support. Regardless, here is a shortlist of a couple of ideas that may inspire you:

Start-up loans – Although bank finance for start-up businesses is not a common occurrence nowadays, other organizations such as local authorities and small business associations may provide funding like a small business loan. The terms and conditions of this loan agreement will be defined and will differ depending on your country of origin, so you will know exactly how much you must repay. However, you may be limited as to how you can spend your funds, and it may take some time and effort to secure it.

Grants – Grants are a fantastic source of start-up finance as it’s a form of income that doesn’t have to be repaid. In Europe, Start-up grants are available from government or EU-backed initiatives such as InnovateUK, Horizon2020, or British Small Business Grants. If you want to secure a grant can help raise your business’s reputation with investors and prospective customers. The backlash is that the process can take a lot of time, and not all businesses will be eligible.

Keeping your data safe

It’s worth ending this guide to starting a business with a note of caution (don’t worry, there are no curses to worry about). The majority of small business owners still haven’t either acknowledged or taken the threat of cybercrime seriously. DDOS attacks and large-scale system hacks are a lot more commonplace than you may think.

Just as any security alarm system company or the insurance for their premises, today’s businesses need to consider an approach to protect their activity online. Here’s a shortlist to end with to tell you how:

- Talk about the situation with your IT department if you have one.

- Be prudent about employee access to resources.

- Use various virus and malware scanning across all devices

- Backup data remotely daily.

- Educate employees and train them to spot these attacks

- Update your website and security software regularly.

After you research all of the above and decide on a business, you’ll need a great logo design that helps you stand out from your competition. Developing your logo and brand will be an important part of branding your new business. You’ll want to make sure your logo is simple and unique. A great way to do that is to run a logo contest at LogoMyWay, or use their online logo maker.

We hope this has been a useful and comprehensive guide that will aid you in your journey towards business success. Creating your own company and going through life with your talent and creativity is an incredibly rewarding way to live your life. But with all the freedoms and the benefits come the restrictions and the responsibilities of using them well. We sincerely hope that your journey ends in the place you want it to be – a resounding success, no doubt – but also that you learn the properties, characteristics, and attributes that come with being a successful entrepreneur.